Historic Success of Bitcoin ETFs

Half a year since the launch of Bitcoin ETFs, they have proven to be the most successful ETF launch ever, with a remarkable $309.53 billion in volume. On the first trading day alone, spot-traded Bitcoin ETFs amassed $4 billion, far surpassing the previous record held by the Gold ETF (GLD), which took three days to exceed $1 billion in inflows.

Bitcoin’s Unique Position

Bitcoin’s impressive performance is notable considering it is a new asset compared to the long-established gold. The trend indicates Bitcoin’s suitability for the digital era. But what exactly is its purpose?

Jay Jacobs, BlackRock’s Head of Thematic & Active ETFs, has highlighted Bitcoin as a “potential hedge against geopolitical and monetary risks.” Many are now aware that central banks’ manipulation of the money supply poses significant moral hazards, leading to record-breaking deficits and inflation, which acts as an additional form of taxation.

Advantages Over Gold

Gold, being physical, confiscatable, and not strictly limited, is less effective in countering these issues. In contrast, Bitcoin, though more volatile due to its smaller market size, offers higher potential gains. With Bitcoin ETFs making digital gold more accessible and institutionalized, what steps are needed to sustain this trend?

Ensuring Network Reliability

Due to its proof-of-work (PoW) consensus mechanism, Bitcoin combines digital assets with the physical reality of energy and hardware. This foundation provides Bitcoin’s value as a decentralized alternative to central banking. As the Bitcoin network handles around 412,000 transactions per day—almost double from two years ago—it must scale to support increasing institutional use. Network stability and robustness must be enhanced, addressing components from software and servers to hardware and internet connections.

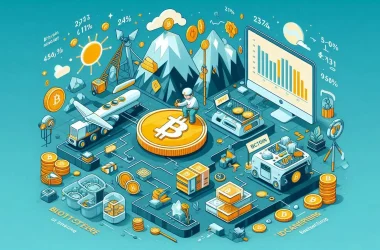

Scalable Blockchain Solutions

IBM’s contributions to blockchain scaling through IBM Blockchain, based on the Hyperledger Fabric framework, exemplify enterprise-grade solutions. These could interface with the Bitcoin ecosystem via atomic swaps and smart contracts. Similarly, Visa’s Universal Payment Channel (UPC) framework and SWIFT’s atomic settlement capability highlight the potential for blockchain interoperability.

Dependable Servers

Hardware solutions, whether internal servers or external options like the Canton Network, are crucial for scalable blockchain solutions. The Canton Network, leveraging Daml smart contract language, allows for decentralized infrastructure with expandable servers. Outsourcing to such networks enables businesses to focus on core functions rather than IT management.

Internet Connectivity

Blockchain nodes require continuous communication for transaction validation and settlement. Redundancies and failover strategies are essential. For instance, Solana addressed network downtime by developing Firedancer, a secondary network validator client. The Canton Network’s support from major tech and banking firms ensures robust redundancy and load balancing.

Enhancing Network Performance

Packet loss and jitter are inherent in computer networks, causing delays and data stream disruptions. Techniques like Forward Error Correction (FEC) and quality of service (QoS) configurations help manage these issues. The Bitcoin network benefits from its decentralized design, which offsets delays through multiple confirmations and maintains block time via an auto-adjusting difficulty mechanism.

On-site vs. ISP Solutions

Organizations can manage IT infrastructure on-site for greater control and faster response times but at higher costs. ISP-hosted solutions offer easier scalability and maintenance, requiring reliable internet connections. Tools like Amazon Web Services’ (AWS) Global Accelerator enhance network performance, making AWS a key blockchain infrastructure pillar. Companies like Block are setting new standards with their innovative Bitcoin mining networks.

Sustainable Energy Solutions

Bitcoin’s proof-of-work (PoW) algorithm, while energy-intensive, is crucial for network security. Over 50% of the Bitcoin network now uses renewable energy sources. Research by Daniel Batten indicates significant use of hydro, wind, solar, and nuclear power. Bitcoin mining is also helping balance power grids, with companies like Bitdeer and Riot Platforms stabilizing grids during peak demand. The shift to renewable energy, driven by major investors like BlackRock, signals a move away from the “dirty Bitcoin” narrative.

Conclusion

In 2022, gold mining produced three times the carbon emissions of Bitcoin. Since then, Bitcoin has vastly outperformed gold ETF capital inflows. Bitcoin, as an asset immune to tampering and controlled by no one, backed by cryptography, hardware, and energy, is set to rise. The ecosystem is ready to grow, leveraging lessons from blockchain networks and mining companies.

Bitcoin ETFs’ historic success and ongoing innovations in network reliability, scalable solutions, and sustainable energy highlight the digital asset’s potential for continued institutional adoption and growth.

The post How institutional networks are preparing for Bitcoin integration appeared first on CryptoSlate.