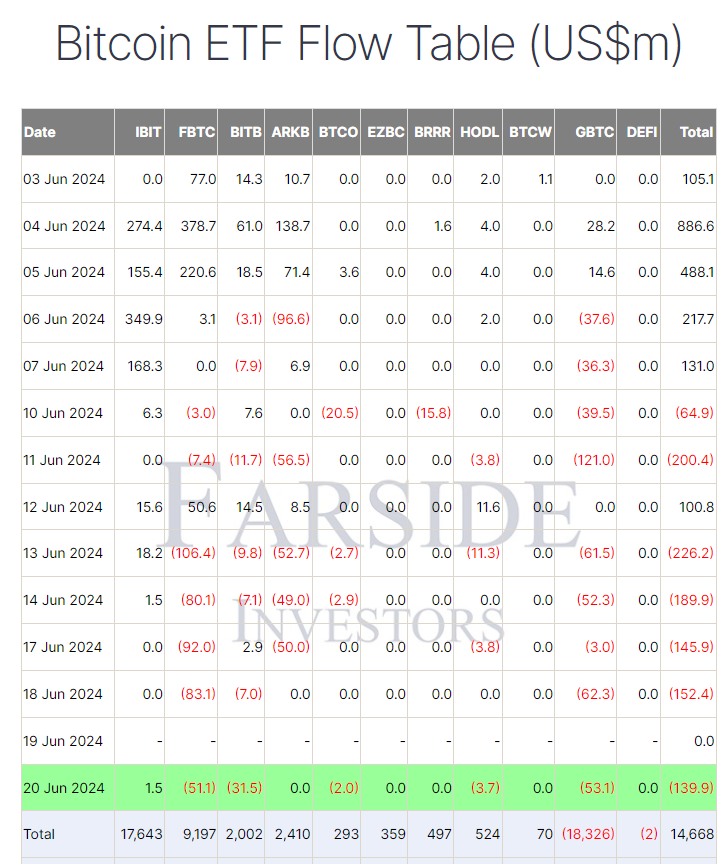

On June 20, Farside data indicated a significant net outflow of $139.9 million from Bitcoin (BTC) exchange-traded funds (ETFs). This marks the fifth straight day of outflows and the seventh occurrence in the last eight trading days. BlackRock’s IBIT was the sole ETF issuer to report an inflow, which, although modest at $1.5 million, contributed to a total net inflow of $17.6 billion for the fund.

Major ETF Issuers Report Outflows

Five other ETF issuers experienced outflows on this day. Leading the outflow trend was Grayscale’s GBTC, which saw $53.1 million in outflows, bringing its total outflow to $18.3 billion. Fidelity’s FBTC reported an outflow of $51.1 million, reducing its total net inflow to $9.2 billion. Bitwise’s BITB also faced a significant outflow of $31.5 million, lowering its total inflow to $2.0 billion.

Net Inflows Remain Substantial

Despite these outflows, the total net inflows to Bitcoin ETFs remain substantial, standing at $14.7 billion according to Farside data.

The post Fifth consecutive trading day of Bitcoin ETF outflows totals $139.9 million appeared first on CryptoSlate.